Digital banking failures aren’t rare; they’re frequent and costly. Performance failures ripple across business functions—from failed logins to delayed fund settlements. With real-time payments, mobile-first interactions, and tightening regulatory frameworks, banks must ensure their applications are always available, fast, and compliant.

Modern banks operate through complex, multi-tiered architectures with thousands of interdependent components, ranging from UPI and mobile banking platforms to core banking systems and fraud detection engines. Service disruptions can translate into regulatory, financial, and reputational impact. This highlights the need for post-incident visibility and correlated tracing, which application performance monitoring solutions are designed to deliver. Site24x7’s application monitoring solutions help banks continuously observe, analyze, and improve their digital infrastructure across channels, reducing risk and maintaining service-level consistency.

What are the common challenges in monitoring banking and fintech applications?

Modern banking stacks are multilayered, cloud-distributed, and increasingly dependent on third-party APIs, making observability a complex task. Here are some of the most pressing challenges monitoring teams face:

1. Tool sprawl and fragmented visibility

Banks often use separate tools for infrastructure, logs, application metrics, user behavior, and security. This fragmentation makes it harder to correlate issues across systems, delays triage, and increases operational overhead.

2. High transaction volume and complexity

With thousands of concurrent transactions per second, tracing a failed payment across services like authentication, fraud checks, and core banking systems becomes a needle-in-a-haystack problem without unified tracing.

3. Third-party and legacy system blind spots

Many banking services rely on payment gateways, KYC vendors, or legacy core systems that offer little-to-no monitoring hooks, leaving critical dependencies untracked.

4. Regulatory pressure on uptime and compliance

Downtime or delays can result in more than customer complaints—they can trigger regulatory penalties. Monitoring needs to help prove compliance with audit trails and SLA metrics.

5. Noise fatigue from alert storms

Without intelligent alerting and baselining, banking teams get flooded with redundant alerts during high-traffic periods—causing teams to miss real threats.

6. Loss of trust equals loss of revenue

In fintech and banking, performance issues aren’t just technical—they’re business risks. A failed transaction, even if intermittent, can erode customer trust and send users to competitors.

Why APM is critical for banking reliability and compliance?

Today, banking systems span across digital experiences, backend orchestration, third-party integrations, and branch-level infrastructure. Even a few seconds of delay can lead to failed transactions or reputational damage.

Site24x7 APM ensures performance, availability, and visibility across your entire banking stack—so you can stay resilient and responsive. Here’s how it fits into your operations:

- Customer experience and engagementMonitor digital CX tools, like Sprinklr, for campaign responsiveness, social engagement, and downtime impact.

- Customer relationship and onboarding workflowsEnsure platforms like Salesforce run smoothly for lead tracking, KYC, and service ticketing.

- Core banking and transaction processingObserve platforms such as Finacle, Temenos, and Flexcube, where even small delays can disrupt transaction flows.

- ATM availability and service healthTrack uptime, response failures, and integration delays between ATMs, card switches, and core banking systems.

- Enterprise resource and content managementGet visibility into performance metrics of internal systems like SAP, Oracle, and Adobe Experience Manager that drive HR, finance, and content ops.

- Payments and API integrationsMonitor latency, retries, and failures across UPI payments, card transactions, and third-party payment gateways.

From transaction-level tracing to real-time alerts, Site24x7 APM helps banks proactively detect issues, reduce MTTR, and deliver a seamless experience across every customer-facing and backend touchpoint.

What customer-centric KPIs matter for digital banking success?

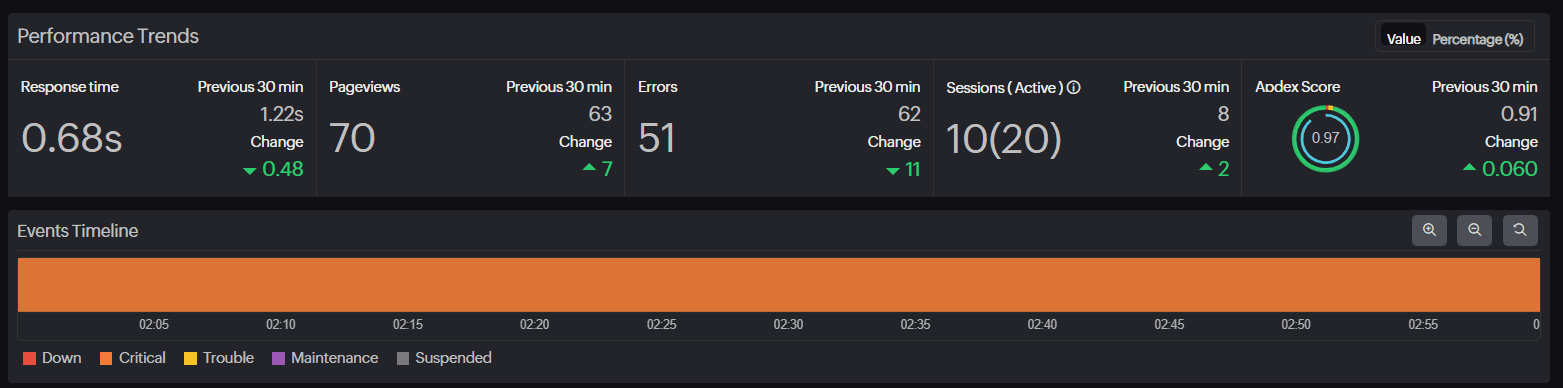

Digital banking users expect instant access, zero friction, and responsive experiences—across devices, time zones, and transaction types. Performance blind spots often emerge not because teams aren't monitoring, but because they're tracking the wrong metrics.

| KPI | Customer benefit |

|---|---|

| Transaction performance | |

| Latency in key flows | Enables quick and reliable fund transfers globally. |

| Failed transaction rate | Prevents user frustration from declined or stalled payments |

| Payment gateway errors | Ensures smooth handoffs between your app and third-party systems. |

| App and portal experience | |

| Mobile app crash rate and load time | Improves app store ratings and reduces churn. |

| Page load time for dashboards | Speeds up access to balances and insights. |

| Session duration | Indicates engagement with personalized features. |

| Authentication and access | |

| Login attempt success rate | Reduces friction during sign-in, preventing user abandonment from the start. |

| Multi-factor authentication (MFA) latency | Ensures fast transactions without disrupting the user journey. |

| Regional uptime and compliance | |

| Downtime for geo-specific services | Guarantees regional availability and SLA adherence. |

| Geo-load distribution and access latency | Balances backend routing for users in different time zones or regions. |

These KPIs help teams move from backend metrics to experience metrics—connecting engineering performance with customer happiness.

What metrics matter most in banking APM?

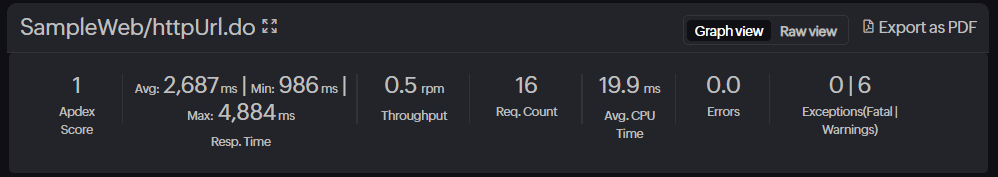

Modern banking platforms generate terabytes of telemetry across apps, APIs, infrastructure, and customer devices. APM cuts through the noise by capturing structured, time-series performance indicators across four planes:

Application-layer metrics

- Service latency (P50, P95, P99) and error rates per transaction class

- Thread pool saturation, GC pause times, and JVM memory utilization

- API throughput, retry rates, and third-party dependency latency

- Backend call timing (databases, caches, message queues, auth servers)

Infrastructure performance metrics

- Host/container CPU, memory, disk I/O, and network throughput

- Load balancer behavior and connection health

- Node-level health for mainframe and cloud-native components

- K8s pod restarts, autoscaler activity, cloud throttling

Business and transaction KPIs

- Time-to-complete for UPI, NEFT, or RTGS payments

- Failure rates per function: fund transfer, bill pay, KYC update, login

- Drop-offs by region, device class, or bank network (PSP, acquirer)

- Conversion metrics tied to A/B tested UI workflows

- Net Interest Margin (NIM) impact of service availability or latency

User experience (UX) metrics

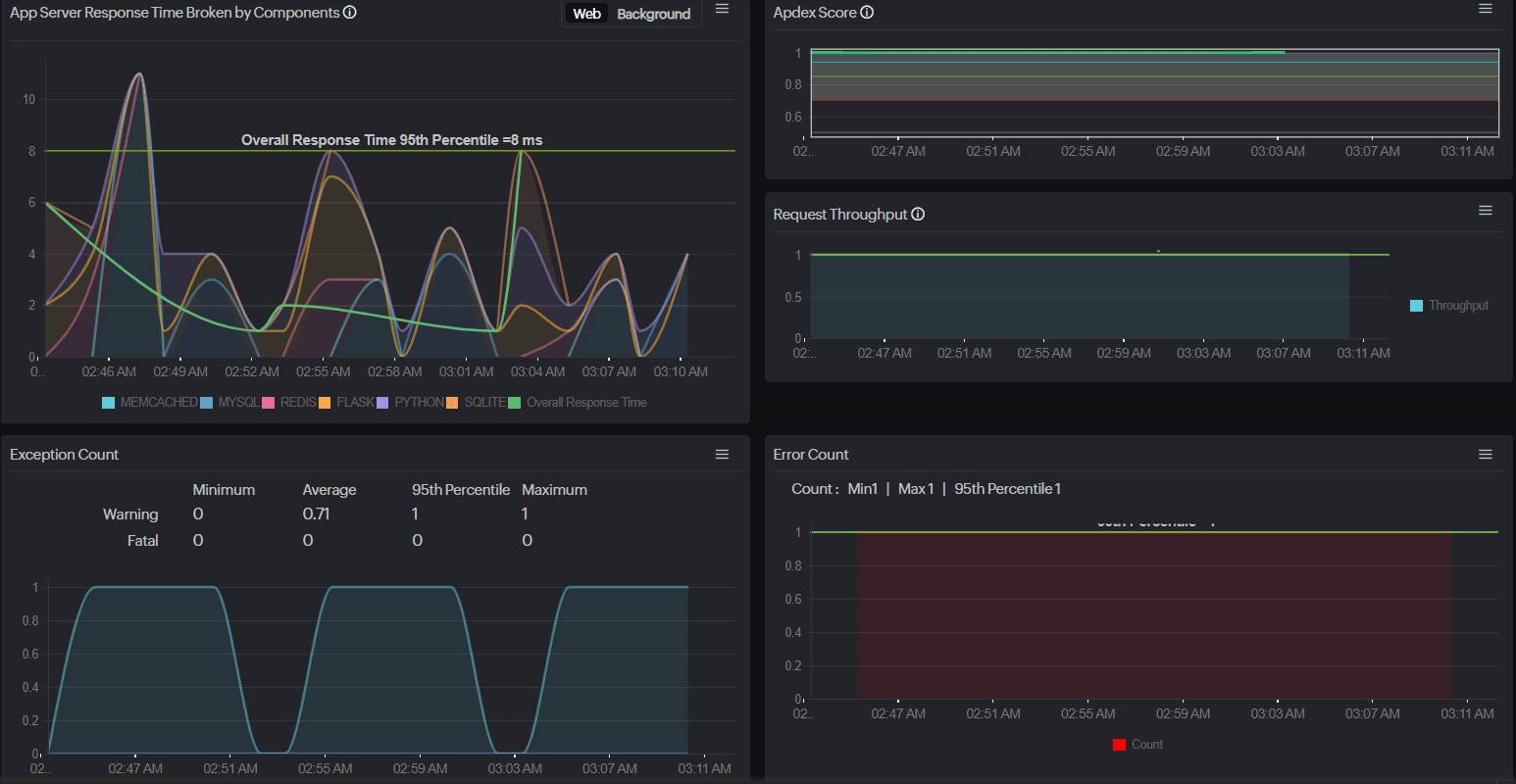

- Apdex and web vitals (TTFB, FID, CLS) across devices

- Mobile crash rate, page load heatmaps, JS errors, and resource load timing

- Session segmentation: device model, OS version, ISP, geography

- Session replay with user clickstream for failed interactions

These metrics power dashboards, SLA engines, anomaly detection pipelines, and incident workflows—ensuring both engineering and compliance stakeholders have actionable visibility.

How can APM trace the full journey of every transaction?

In modern banking, a single transaction often crosses dozens of services. For example, a UPI transaction might touch:

- Frontend API Gateway

- Auth microservice (token validation, rate limiting)

- Risk/fraud engine (AML scoring, limits)

- Core banking orchestration (ledger update, account lock check)

- Third-party PSP integration

- Notification service (SMS/Push confirmation)

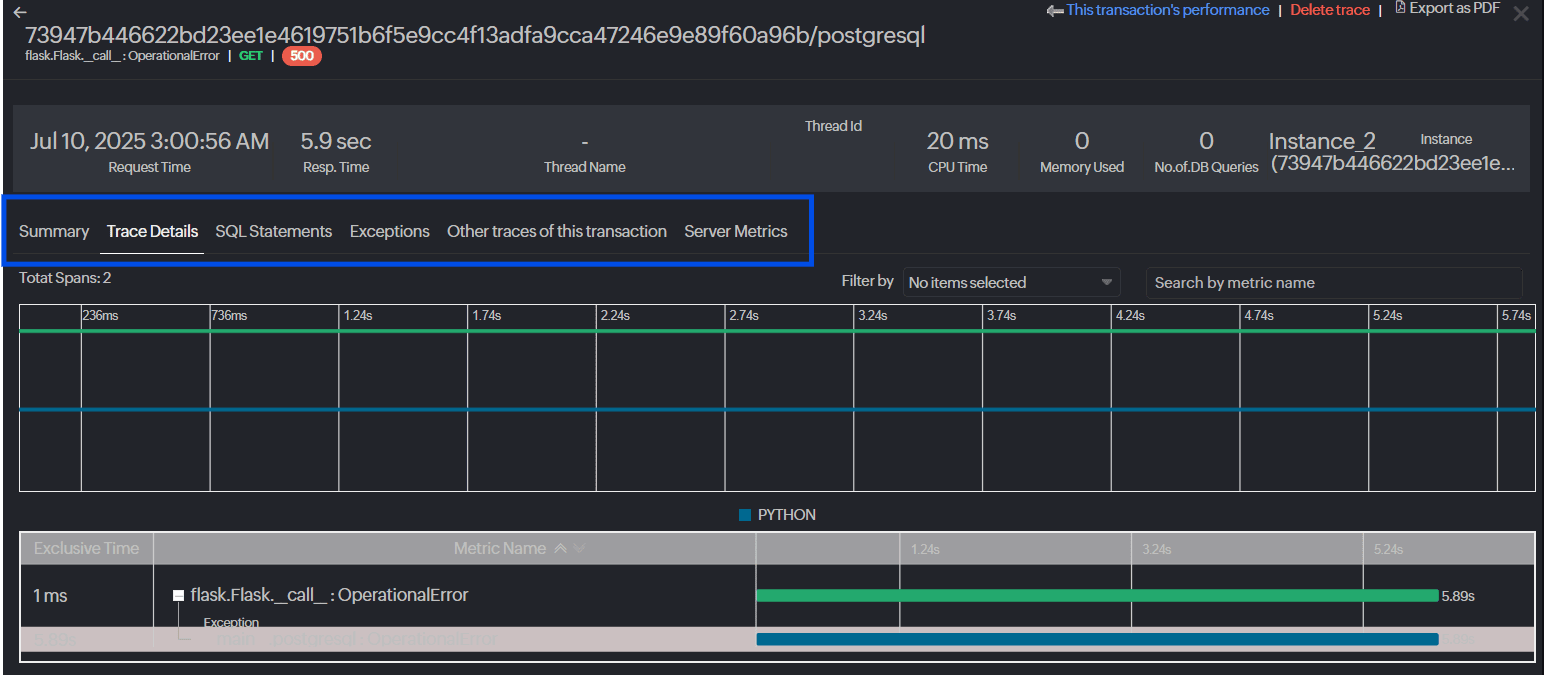

Distributed tracing allows engineers to stitch the full execution path of a fund transfer, OTP verification, or loan application—from browser request to core banking and third-party APIs.

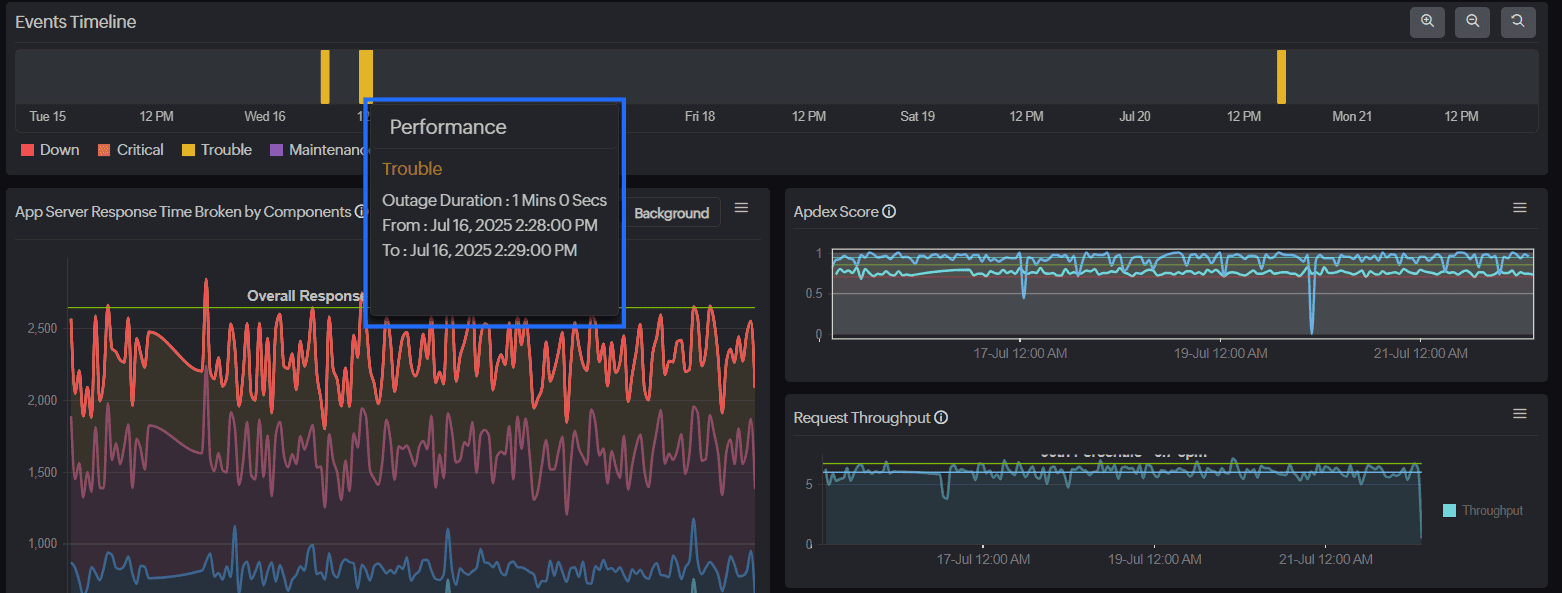

APM tools inject trace context headers (e.g., traceparent, baggage) to create span-linked timelines. This allows teams to detect if latency spikes originate from the PSP handoff or a downstream ledger call—critical during SLA breaches. Such tracing is invaluable during incidents, offering engineers a single-pane RCA view without manually combing through logs.

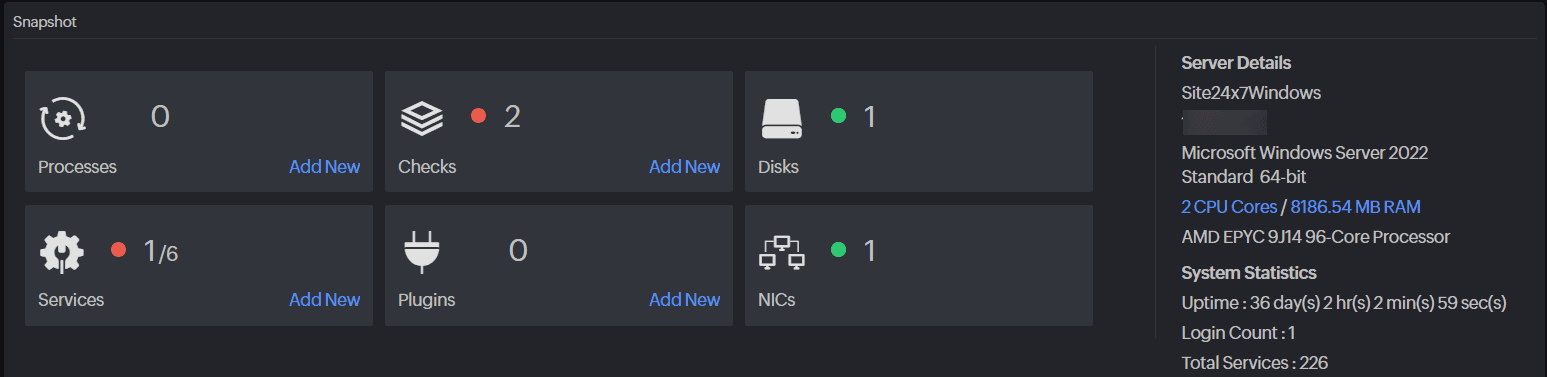

How does infrastructure telemetry help identify root causes?

APM integrates with infrastructure telemetry to surface hidden root causes behind incidents to create correlated alerts and insights. In complex banking systems—like in the case of Barclays' desktop outage, which reportedly involved legacy systems—failures often stem beyond the app layer.

With full-stack observability, APM reveals when application-level issues are symptoms of deeper infrastructure bottlenecks, such as:

- Node memory spikes during high volume database queries

- Pod restarts linked to container OOM errors

- CPU saturation or blocked I/O queues on mainframe nodes

- Cloud disk I/O throttling or API rate limits

- Regional network jitter affecting fund transfers

Banks often run hybrid infrastructure—with cloud-native microservices in Kubernetes, legacy mainframe systems accessed via MQ, and external APIs. APM must normalize metrics across Prometheus, OpenTelemetry (custom spans/logs) and cloud native monitoring tools.

This cross-domain observability (infra + application + trace) ensures engineers move from symptom to cause quickly—minimizing guesswork.

How does real user monitoring improve digital banking experience?

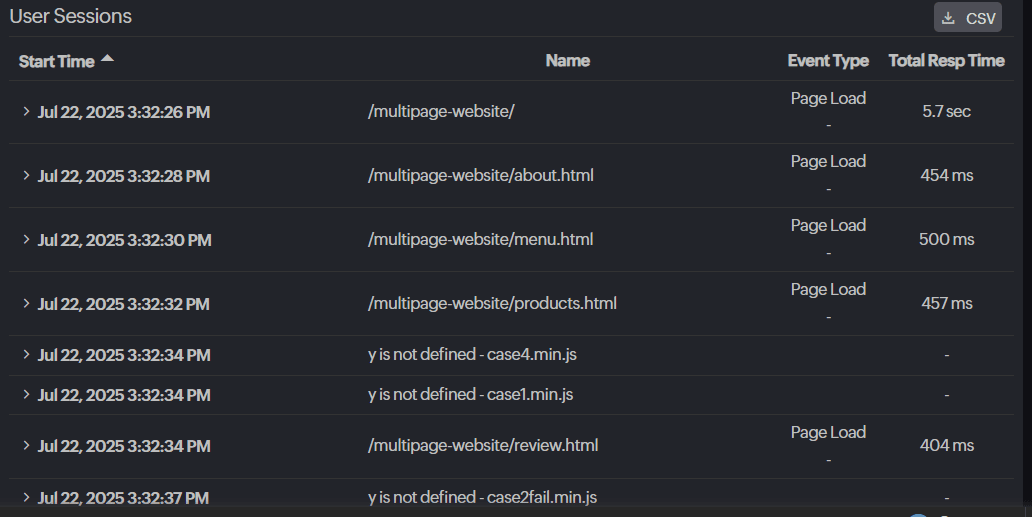

Real user monitoring (RUM) tracks frontend performance and user interactions across both mobile and desktop banking platforms. During service disruptions, RUM can help surface broken frontend-backend handshake failures that triggered login errors or blocked transactions.

It can reveal timeout trends segmented by browser, OS, or device model—pinpointing whether, for instance, Android users faced prolonged app load times during the outage window. By tracking real clicks, session freezes, and user drop-offs, RUM builds a clear picture of the user journey under stress. When paired with backend traces, it bridges the gap between what users experience and what the system processes—speeding up root cause identification and rollback validation. This is especially crucial during post-release impact checks or customer escalations where backend systems appear healthy.

How can AI-powered alerts reduce incident fatigue?

In large banks with multi-cloud, legacy, and third-party components, alert fatigue is real. With telemetry flooding in from hybrid environments, AI helps teams focus on what matters most—actual performance degradation. By learning behavioral patterns and establishing baselines, AI/ML in APM has shifted from threshold-based alerts to context-aware, auto-prioritized incidents.

| AI capability | How it helps |

|---|---|

| Forecasting | Learns diurnal and seasonal patterns per service or region, reducing false alerts. |

| Anomaly detection | Flag deviations using change rate, derivative spikes, or entropy-based thresholds. |

| Causal graphing | Maps downstream error floods to the root transaction node for faster triage. |

| Event correlation | Collapses redundant alerts to reduce fatigue and focus on what matters. |

| IT automation | Launches scripts, scaling policies, or ticketing workflows via webhooks to fix issues faster. |

For teams managing tens of services across regions and compliance zones, AI helps avoid war-room fatigue and enables faster resolution without over-alerting.

How does APM support compliance and post-incident audits?

Post-incident audit and RCA readiness

Site24x7 APM offers detailed observability data that helps your teams conduct root cause analysis and prepare for audit reviews. With metric retention, event trails, and SLA snapshots, you can:

- Generate detailed post-incident reports to support RCA and audit reviews.

- Retain trace and log telemetry aligned with governance policies.

- Leverage Site24x7’s APIs to integrate with the centralized logging and monitoring mechanism (LAMA) for scheduled reporting and regulatory traceability.

Regulatory compliance

Ensure your cloud environments and application configurations meet global regulatory standards. With built-in compliance checks, you can:

- Automate configuration and performance audits to meet internal controls like ITGC or SOX.

- Validate AWS infrastructure against standards like PCI DSS, NIST, and CIS Controls.

- Detect security vulnerabilities and non-compliant configurations across your cloud footprint.

What’s next for APM in banking?

The next evolution of APM is toward autonomous incident mitigation and governance-aware observability. Future-ready features include:

- Agentic AI: Contextual agents that analyze a trace, simulate rollback vs scale-out, execute low-risk actions, and escalate based on confidence thresholds.

- FinOps observability: Show direct correlation between cloud spend, performance improvements, and business value (e.g., reduced OTP drop-offs)

- Zero-trust tracing: Every span includes auth context and data access traceability

- Edge observability: Monitoring performance from user devices to edge API gateways to core systems, especially in mobile-heavy regions with a degraded user experience.

Modern APM is shifting from reactive war rooms to proactive, autonomous incident handling, with capabilities like AI forecasting and scenario simulation becoming integral to resilient banking operations.

Conclusion

Banking resilience isn’t just about avoiding outages—it’s about responding with speed, clarity, and evidence. From frontend crashes to mainframe slowdowns, modern APM gives banks the traceability, intelligence, and automation they need to operate at digital scale.

By embracing APM enriched with AI, security integration, and compliance controls, banks move from reactive incident response to proactive service governance. Digital banking isn’t just about uptime—it’s about trust. With full-stack APM, banks gain visibility into every customer tap, backend trace, and core system transaction—ensuring trust is built into every layer.